Sage X3 Fixed Assets

Sage X3 Fixed Assets is a module within the Sage X3 enterprise resource planning (ERP) system that enables you to effectively and efficiently track your organization’s fixed assets throughout their entire lifecycle.

Here are some of the benefits of using Sage X3 Fixed Assets:

- Improved Asset Management: Sage X3 Fixed Assets provides a centralized repository for all fixed asset information, including acquisition and disposal information, depreciation calculations, and maintenance records. This makes it easier for organizations to track and manage their fixed assets.

- Increased Accuracy: Sage X3 Fixed Assets automates many of the manual processes associated with fixed asset management, reducing the risk of errors and improving data accuracy.

- Better Visibility: Sage X3 Fixed Assets provides real-time visibility into the status of fixed assets, including their location, condition, and depreciation. This enables organizations to make more informed decisions about their fixed assets.

- Better Compliance: Sage X3 Fixed Assets helps organizations to meet regulatory requirements related to fixed asset management, such as tax compliance and financial reporting.

- Improved Reporting: Sage X3 Fixed Assets provides a range of reports and dashboards that enable organizations to analyze and understand their fixed asset data. This can help organizations to make more informed decisions about their fixed assets and to optimize their asset utilization.

- Integration with Other Systems: Sage X3 Fixed Assets can be integrated with other systems, such as accounting, procurement, and inventory, to provide a comprehensive view of an organization’s fixed assets.

Overall, Sage X3 Fixed Assets provides organizations with a powerful tool to manage and track their fixed assets, enabling them to make informed decisions and improve their asset utilization.

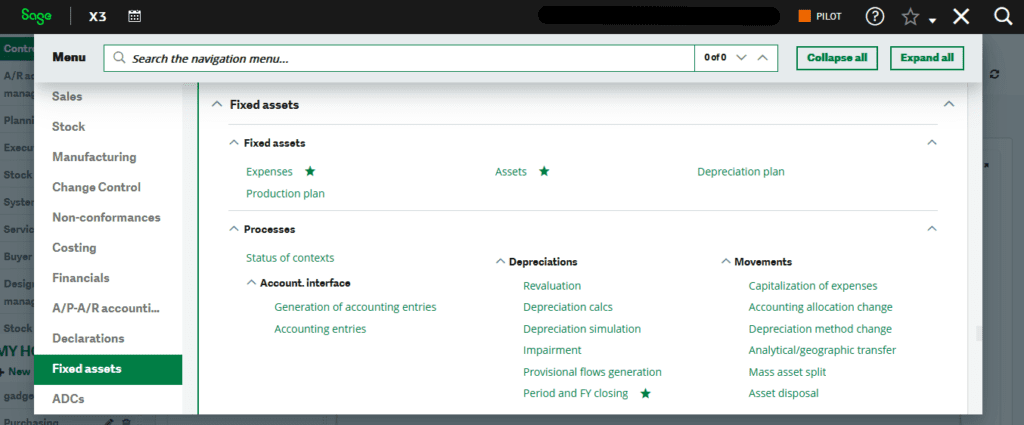

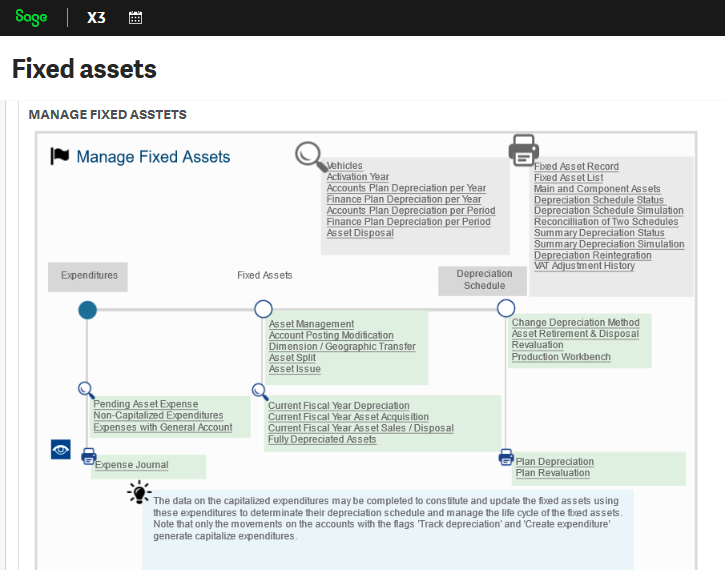

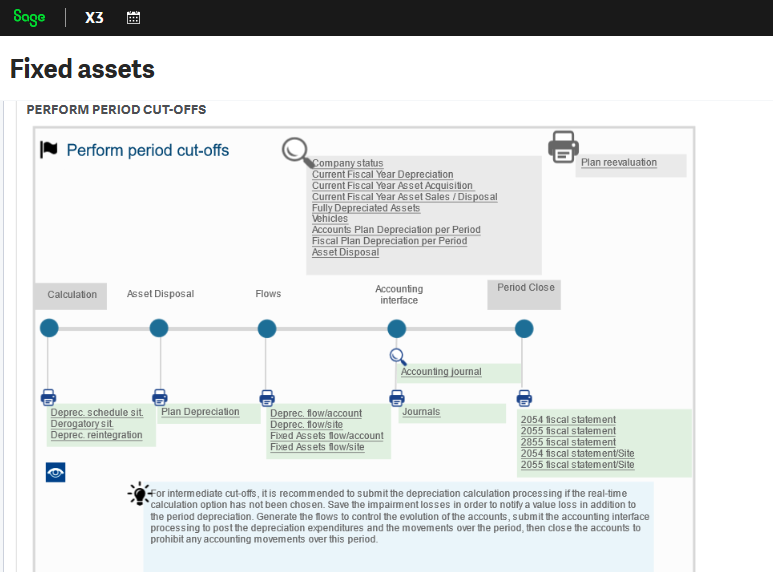

Sage X3 Fixed Asset Personalized Landing Pages helps you drive key operational flows in an organized and seamless way.

Manage Fixed Assets

Perform Period Cut-Offs

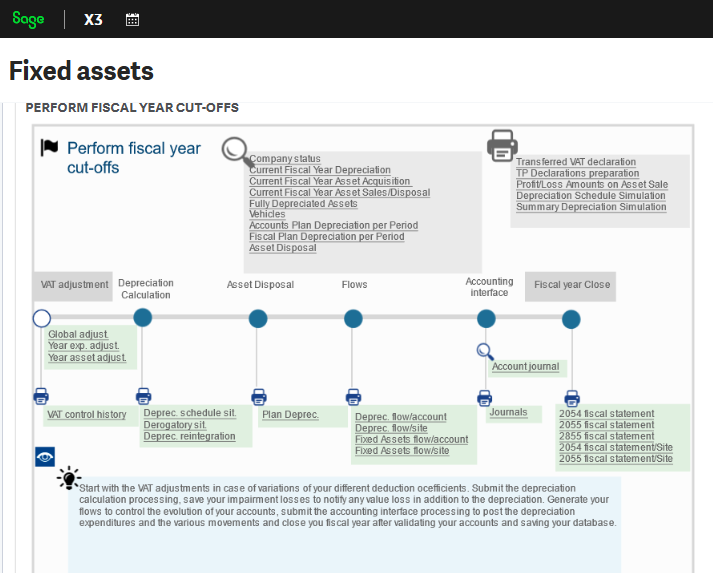

Perform Fiscal Year Cut-Offs

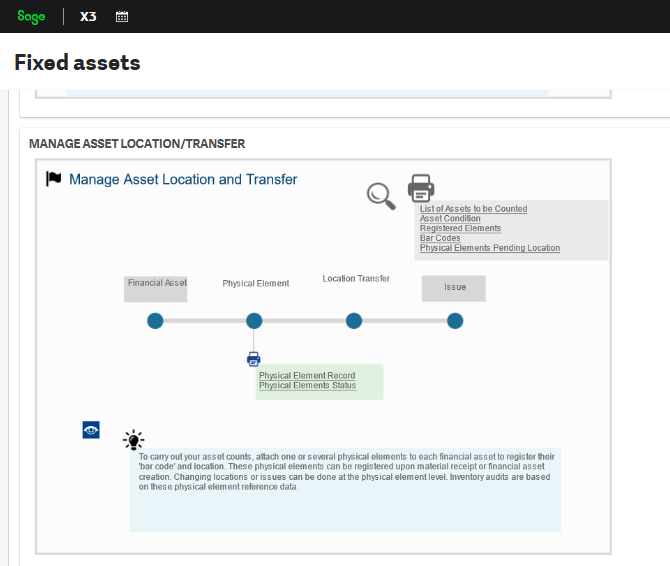

Manage Asset Location/Mange Asset Transfers

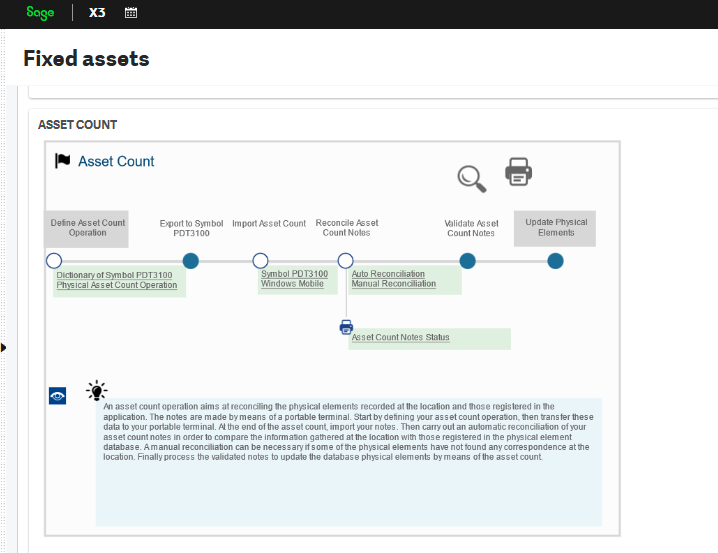

Fixed Asset Counts

Numerous Depreciation Models

Fixed assets are long-term tangible assets that a company uses to generate income. Depreciation is the process of allocating the cost of a fixed asset over its useful life. There are several depreciation models that companies can use to calculate the amount of depreciation expense to be recognized each accounting period, including:

- Straight-Line Depreciation: This is the simplest method where the cost of an asset is spread evenly over its useful life.

- Declining Balance Depreciation: This method uses a fixed percentage rate applied to the asset’s book value to calculate depreciation. Each year, the asset’s depreciable base is reduced, leading to a higher rate of depreciation in the early years of its life and a lower rate in later years.

- Sum-of-the-Years’ Digits Depreciation: This method uses a fraction based on the asset’s estimated useful life, where the numerator is the number of remaining useful years and the denominator is the sum of the useful years.

- Unit of Production Depreciation: This method calculates depreciation based on the asset’s actual usage or production, rather than its passage of time. This method is commonly used for assets like machinery and equipment.

- Modified Accelerated Cost Recovery System (MACRS): This is a tax-based method used for calculating depreciation for tax purposes in the United States.

The choice of a depreciation model depends on various factors, including the nature of the asset, accounting regulations, and the company’s tax position.

Fixed asset lifecycle with traceability of capital expenditure

The fixed asset lifecycle is the process that a fixed asset goes through from acquisition to disposition. The stages of the fixed asset lifecycle are:

- Acquisition: This is the first stage where a company acquires a fixed asset either through purchase or construction.

- Deployment: Once the asset is acquired, it is put into use and generates revenue for the company.

- Maintenance: Regular maintenance is carried out to ensure that the asset remains in good working condition.

- Depreciation: During the deployment stage, the asset is depreciated over its useful life to reflect its declining value.

- Retirement: When an asset reaches the end of its useful life, it is retired from service and removed from the company’s balance sheet.

- Disposition: The final stage is the disposition of the asset, where it is sold, scrapped, or disposed of in some other manner.

The fixed asset lifecycle helps companies keep track of their fixed assets and ensures that they are properly accounted for. It is important to manage fixed assets effectively, as they represent a significant portion of a company’s assets and can have a significant impact on financial statements.

Fixed Assets Interim Statements and Closing

Fixed assets are a long-term tangible asset that a company uses to generate income. The interim financial statements are financial reports that are issued before the company’s annual financial statements, and the closing process is the process of preparing the company’s year-end financial statements.

In the interim financial statements, the value of fixed assets is reported at the cost less accumulated depreciation. The depreciation expense for the interim period is calculated and recognized in the income statement. Any additions or disposals of fixed assets during the interim period are also recorded and reflected in the balance sheet.

At the end of the year, the closing process involves updating the fixed assets’ records to reflect the latest additions, disposals, and depreciation. The company’s financial statements are then reconciled with the general ledger, and any adjustments required are made to ensure that the balance sheet accurately reflects the value of fixed assets.

Finally, the company’s auditors may perform a year-end review to ensure that the fixed asset records are accurate and complete. The closing process is critical for accurate financial reporting and for maintaining the reliability of the financial statements.

Fixed Asset Stock Count and Financing

Fixed assets stock count refers to the physical counting of a company’s fixed assets to verify their existence and determine their condition. This process is typically performed at regular intervals, such as annually or every few years, to ensure that the company’s records are accurate and complete.

Fixed asset financing refers to the funding that a company obtains to purchase or upgrade its fixed assets. This can be in the form of debt financing, such as a loan or line of credit, or equity financing, such as issuing stock or raising funds through a private placement.

Fixed assets play a crucial role in a company’s operations and often represent a significant portion of its assets. Accurate and complete records of fixed assets are essential for financial reporting and tax purposes. By financing its fixed assets, a company can acquire the assets it needs to operate and grow its business while spreading the cost over time.

The stock count and financing of fixed assets are closely related, as accurate stock count data can help a company to better manage its assets and make informed decisions about financing. By knowing exactly what assets it has and their condition, a company can determine the most efficient and cost-effective way to finance its fixed assets and support its operations.

Franchised Asset Management

Franchised asset management refers to the management of assets owned by a franchisor, on behalf of its franchisees. In a franchising relationship, the franchisor provides a brand, products, services, and support to its franchisees, who operate their own individual businesses.

In the context of franchised asset management, the franchisor is responsible for acquiring, maintaining, and disposing of assets that are used by the franchisees. This can include physical assets such as equipment, signage, and vehicles, as well as intangible assets like software and training programs.

The franchisor’s role in managing these assets is to ensure that they are used efficiently and effectively, to provide consistent quality and service across all franchise locations, and to maximize the return on investment for the franchisor and its franchisees.

Franchised asset management is an important aspect of a successful franchising relationship, as it helps to ensure that franchisees have the resources they need to operate effectively and meet customer needs, while also allowing the franchisor to maintain control over key aspects of its brand and operations. Effective franchised asset management requires strong communication, collaboration, and trust between the franchisor and its franchisees.

Fixed Asset Financial Reporting & Dashboards

Fixed asset financial reporting in Sage X3 includes detailed information on the value of fixed assets, depreciation expense, and other related costs. Users can access real-time data on fixed assets, including acquisition costs, depreciation methods, useful lives, and accumulated depreciation. This information can be used to produce balance sheets, income statements, and other financial reports.

Sage X3 also provides dashboards that allow users to view key metrics and performance indicators related to their fixed assets. These dashboards provide a visual representation of data, such as asset utilization, depreciation expense, and asset turnover, and can help users to quickly identify trends, analyze performance, and make informed decisions.

In summary, Sage X3’s fixed asset financial reporting and dashboards provide a comprehensive and user-friendly solution for managing and reporting on fixed assets. They offer companies the ability to gain insights into their fixed assets, improve their financial reporting accuracy, and make more informed decisions about their assets and operations.